Local general revenue

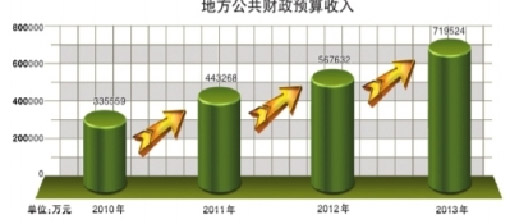

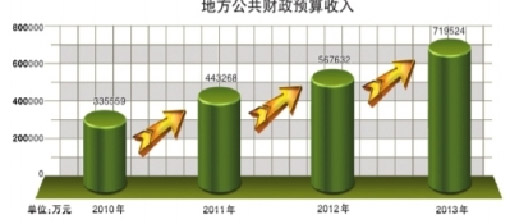

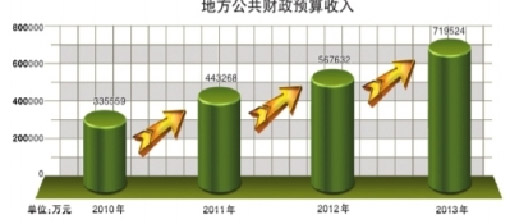

In 2013, Jingzhou’s general revenue exceeded ten billion yuan for the first time, standing above the goals together with local public budgeted revenue. The annual general revenue reached 11.317 billion yuan, 107.5% of the 10.532 billion yuan budget, up 23.2% over 2012. The public budgeted revenue hit 7.195 billion yuan, 110.2% of the 6.53 billion yuan budget and 105.6% of the target of 6.812 billion yuan, increasing by 26.8% over the previous year.

Local public budgeted revenue

There are three main highlights in Jingzhou’s 2013 general revenue. First, the general revenue grew stably. It is learned that all the ten tabulating units in Jingzhou surpassed their targets and the public budgeted revenue of agencies subordinate to Jingzhou municipal government, Jingzhou District and Shashi District all surpassed one billion yuan respectively. Secondly, taxes closely related to economy all increased simultaneously. Added-value tax rose by 18% to 3,264.34 million yuan. Consumption tax increased by 15.9% to 457,56 million yuan. Corporate income tax grew by 18.2% to 1,608.19 million yuan. Thirdly, lax tax grew relatively fast. Land value added tax reached 290.9 million yuan, an increase of 95.1%. Contact tax was 464.11 million yuan, up 63.7%. Farmland conversion tax was 250.01 million yuan, up 60.0%. These three tax categories increased by 416.18 million yuan in total, accounting 38.1% of the increased tax revenue.

In the past year, Jingzhou’s total general revenue and public budgeted revenue continued to grow to another new level. Meanwhile, there were still some problems in general revenue worth attention in the last year. First, the growing rate of main taxation revenue categories slowed down. In 2013, Jingzhou’s tax revenue grew by 25.7%. Among the main four tax categories, added-value tax increased by 18.0%, business tax by 32.2% and corporate income tax by 18.2%. Compared with the annual growth of 2012, the growth rates of value-added tax, business tax and corporate income tax dropped significantly. Second, the agencies subordinate to the municipal government had a relative poor performance. The general revenue and public budgeted revenue of such agencies rose by 14.2% and 15.9% respectively, staying at the bottom among the ten tabulating units. Thirdly, municipal tax took less account in general revenue. According to the standards of provincial assessment, Jingzhou municipal (including Jingzhou Development Area) tax should at least account for 70.0% of public budgeted revenue. However, the actual proportion was 68.2% in 2013 and failed to meet the assessment target, reducing by 2.6 percentage points over the same period of last year.